Compare ACS Financials to Realm Accounting.

See for yourself how Realm Accounting is designed specifically for churches. With fund accounting and a full integration with Realm Contributions, your financial team will thank you for equipping them with better tools for their ministry.

ACS

Realm

Check out the in-depth comparison of ACS Financials and Realm Accounting.

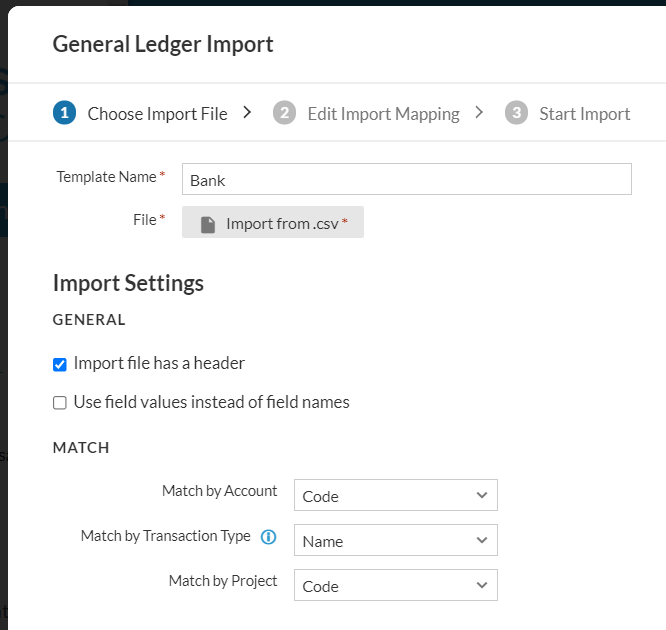

Import your general ledger transactions.

Just as you imported transactions from third-party companies in ACS Financials, you can import transactions into Realm Accounting using the GL Import. When importing a spreadsheet, map columns to fields in Realm. Save your mapping settings as Templates to ensure consistency and save you time during imports. Review your imported transactions before accepting them in order to correct any errors. The GL Import in Realm Accounting will add entries as open transactions, and you can edit, delete, or post them as you would any other GL transaction.

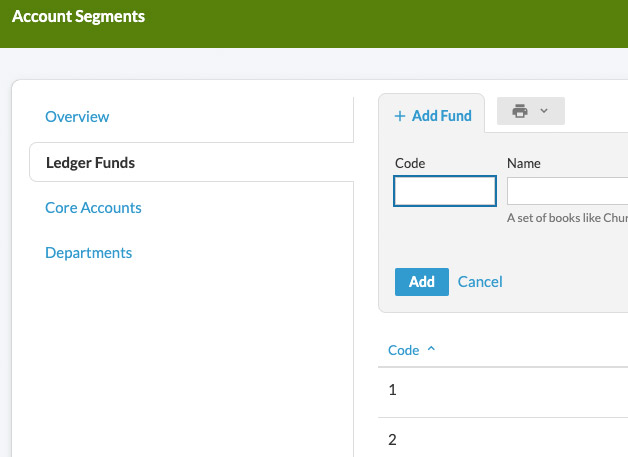

Track more with segments.

Gone are the days when you have to enter the same fund over and over under each ministry. Segments allow you to list values to use with your core accounts. You may have up to five segments: funds, core accounts, departments, and up to two optional, custom segments. When you enter transactions, you will select the appropriate segments that make up the account you want to post to.

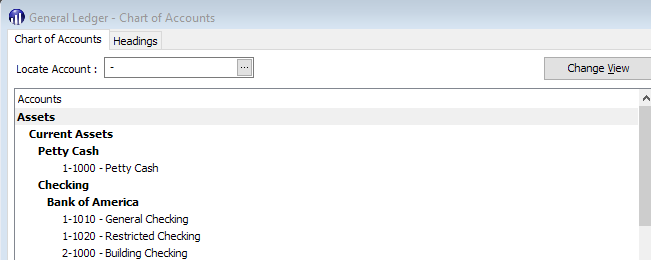

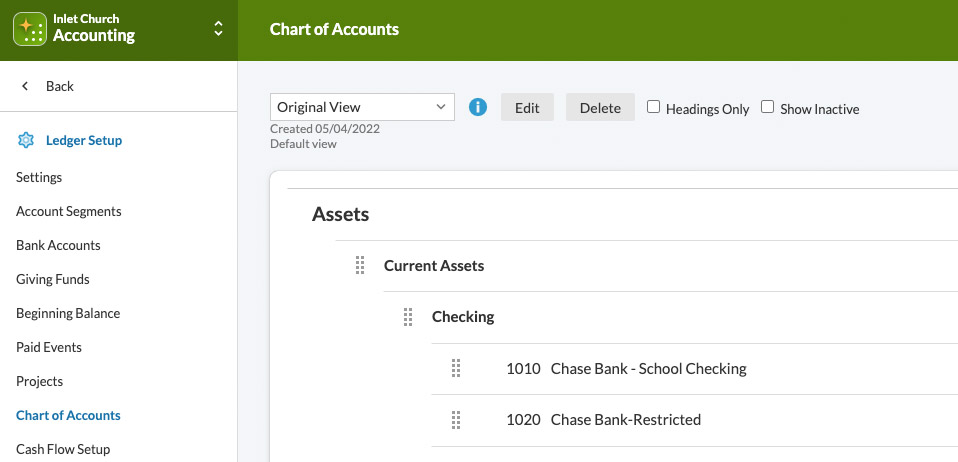

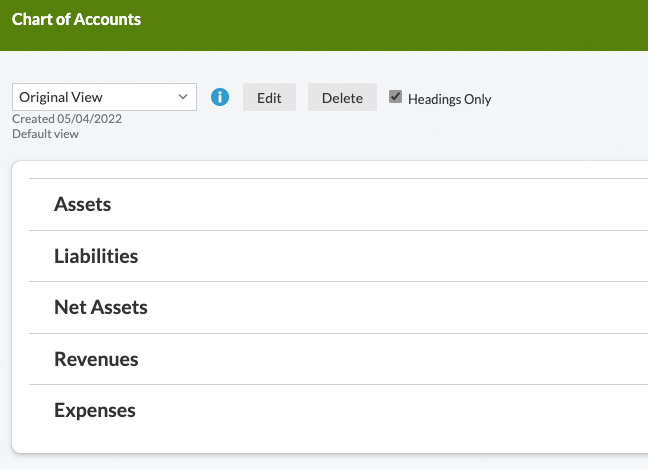

Simplify your Chart of Accounts.

In ACS Financials, your account numbers include the fund number, core account number, and department number. In Realm Accounting, your core accounts are organized below their account headings: Assets, Liabilities, Net Assets, Revenues, and Expenses. Under each heading, you may have subheadings and core accounts.

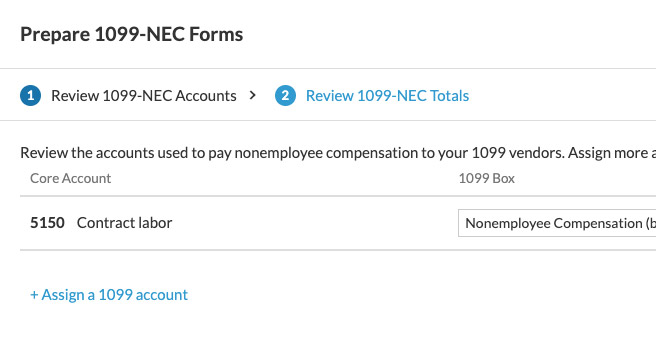

1099’s just got easier.

A major change between ACS Financials and Realm Accounting is Form 1099s. While it may require setup in the beginning, Realm ensures a smoother tax time as your forms will be pulled based on the 1099 expense account you choose to use instead of on the invoice level. All vendors should come over as 1099 vendors, but you will need to go in and make your expense accounts 1099 expenses. In ACS, 1099s are pulled by the vendor and the invoice being marked 1099. In Realm Accounting, 1099s are pulled by the vendor and the expense account being marked instead of the invoice. Plus, tax e-Filing is available in Realm.

Don't start over from square one.

Like most churches, you have many funds for your various ministries and outreach efforts. And while ACS Financials allowed you to track the money behind those ministries, Realm Accounting goes deeper by providing true fund accounting with account segments for you to track even greater details.

But we don’t want you to start all of your financial processes over from scratch. We will transition your chart of accounts, budgets, general ledger transactions, and vendor lists from ACS to Realm. This includes bank accounts, funds, departments, committees, area 1, area 2, projects, and invoices. We also have payroll conversion from ACS to Realm.

For a detailed Mapping Guide on Financials, check with your Implementation Specialist.